Asset Allocation - dividing up a budget among different asset types

|

Table of Contents : The Need Of Investment 2. Where Should I Put My Money? 3. Few of the most well-liked asset classes 4. Asset Allocation - dividing up a budget among different asset types |

The highest profits come from investing in stocks, particularly if you have a long-term investment horizon. The ideal investing portfolio should include a variety of asset classes. Spreading your investments over a variety of asset classes is a smart move.

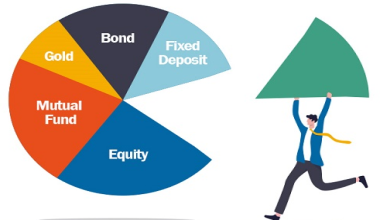

The word "asset allocation" refers to the process of dividing up a budget among different asset types.

Young professionals, for example, might be more willing to take a chance because of their age and years of financial experience. Generally speaking, investors ought to put at least 60% of their investable funds into fixed-income securities, 20% into precious metals, and 20% into equity. The age and risk profile have an impact on the percentage mix. A retired individual might allocate, for instance, 80% of their assets to fixed income (like government bonds), 10% to equities, and 10% to precious metals.

Post Comment