1. Introduction to the Island Reversal The Island Reversal chart pattern is a rare but powerful reversal signal in technical analysis. It forms when a cluster of price bars becomes isolated by gaps

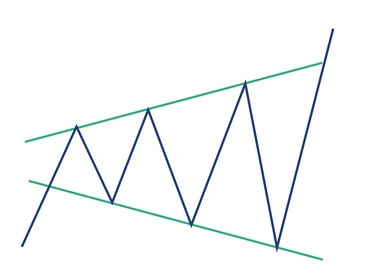

1. Introduction to the Broadening Wedge The Broadening Wedge, also known as the Expanding Triangle, is a chart pattern that reflects increasing volatility. Unlike symmetrical triangles that narrow o

1. Introduction to the Triple Bottom Pattern The Triple Bottom chart pattern is a bullish reversal formation. It occurs when price tests a support level three times without breaking below, signaling

1. Introduction to the Triple Top Pattern The Triple Top chart pattern is a bearish reversal formation. It occurs when price tests a resistance level three times without breaking through, signaling

1. Introduction to Exhaustion Gaps The Exhaustion Gap chart pattern is a technical signal that occurs near the end of a strong trend. It represents a final surge in price, often driven by emotional

1. Introduction to Runaway Gaps The Runaway Gap chart pattern (also known as a measuring gap or continuation gap) is a powerful signal in technical analysis. It occurs midway through a strong trend,

1. Introduction to Breakaway Gaps The Breakaway Gap chart pattern is one of the most powerful signals in technical analysis. It occurs when price opens significantly higher or lower than the previou

1. Introduction to Gaps in Technical Analysis A Gap Chart Pattern occurs when a stock’s price opens significantly higher or lower than the previous closing price, leaving a visible gap on the chart

Many types of trading techniques are used by investors and traders in the stock market to make money from changes in the market. Most people have one of these types: Day Trading: During the same

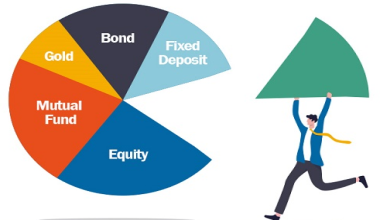

Table of Contents : The Need Of Investment 1. I should invest, but why? 2. Where Should I Put My Money? 3. Few of the most well-liked asset classes �

Table of Contents : The Need Of Investment 1. I should invest, but why? 2. Where Should I Put My Money? 3. Few of the most well-liked asset classes �

Table of Contents : The Need Of Investment 1. I should invest, but why? 2. Where Should I Put My Money? 3. Few of the most well-liked asset classes �

The previous module on the Basics of the stock market set us on a great starting point. Taking cues from the previous module, we know that developing a well-researched point of view is critical for su

Table of Contents : Market Participants and Regulators 1. The stock market: what is it? and Market players 2. Market Regulator - the Securities and Exchange Board o

Table of Contents : Market Participants and Regulators 1. The stock market: what is it? and Market players 2. Market Regulator - the Securities and Exchange Board o

Introduction The Indian derivatives market has undergone significant transformation in recent years. One of the most impactful changes was the introduction of mandatory physical settlement in stock

Introduction In the world of derivatives trading, two terms often confuse beginners: Volume and Open Interest (OI). While both metrics provide insights into market activity, they serve different p

Introduction Financial markets are dynamic, unpredictable, and often volatile. For investors and traders, protecting capital is as important as generating returns. One of the most effective strat

Introduction Futures contracts are among the most widely used financial instruments in global markets. They allow traders, investors, and institutions to speculate on or hedge against the future va

Introduction For years, equity derivatives in India were settled purely in cash. Traders could speculate on stock futures and options without ever worrying about taking delivery of the underlying

A practical guide that explains how volatility, time decay, and strike selection shape profitable call and put option strategies. Options trading is one of the most fascinating areas of finan

Options trading is often described as the most sophisticated segment of financial markets. While stocks move in a linear fashion, options are influenced by multiple variables that interact dynamical

Options trading is a fascinating domain where mathematics, psychology, and market dynamics converge. Among the many tools traders use to measure risk and opportunity, Option Greeks stand out as indi

Options trading is often seen as a complex arena reserved for seasoned professionals. Yet, with the right strategies, even retail traders can manage risk effectively while aiming for consistent re

Introduction Options trading is one of the most dynamic areas of the financial markets. Traders constantly search for indicators and theories that can help them anticipate market moves, manage ri

Introduction Options trading is one of the most versatile areas of financial markets, offering traders the ability to profit from volatility, hedge risks, or generate income. Among the many strat

Introduction Options trading is a fascinating world where strategies can be tailored to suit different market conditions. Among the most popular approaches is the short straddle, a strategy that

Introduction Financial markets are often described as a battlefield of logic and emotion. Traders and investors enter with strategies, data, and forecasts, yet their decisions are frequently influe

Introduction Trading and investing are often portrayed as battles against market volatility, economic cycles, and unpredictable events. Yet, the most formidable opponent is not the market itself�

Introduction Position sizing is one of the most overlooked aspects of trading. While traders often obsess over entry signals, chart patterns, or technical indicators, the true determinant of long-

Introduction Trading is not just about finding the right entry or exit point—it’s about managing risk intelligently. One of the most overlooked aspects of trading is position sizing, the proc

1. Introduction to Electricity Derivatives in India Electricity is one of the most vital commodities in modern economies, powering industries, households, and infrastructure. Unlike traditional

Introduction: Why Government Securities Matter Government securities (G-Secs) are debt instruments issued by the Government of India to raise funds for infrastructure, welfare programs, and fiscal

1. Introduction: Why Cross Currency Pairs Matter in Global Forex Foreign exchange (Forex) is the largest financial market in the world, with trillions of dollars traded daily. While many traders i

Commodity options have emerged as one of the most exciting innovations in India’s derivatives market. With the Multi Commodity Exchange (MCX) introducing options on gold, crude oil, silver, and othe

Introduction: Why Indian Investors Are Looking Abroad In recent years, Indian investors have increasingly sought opportunities beyond domestic markets. The allure of owning shares in global giants

Introduction: Why Financial Reporting Matters in Trading Trading in equities, futures, and options is not just about spotting opportunities in the market—it also involves compliance with taxatio

Introduction: Why Taxation Matters for Traders Trading in financial markets is not just about profits and losses—it also involves navigating the complex world of taxation. For Indian traders, u

Introduction: Why Taxation Matters for Investors Investing in stocks, mutual funds, real estate, or even digital assets is not just about generating wealth—it’s also about managing taxes effi

Introduction: Why Retail is the Backbone of Consumer Economies Retail is more than just selling products—it is the final link in the supply chain that connects manufacturers with consumers. Wheth

Introduction: Hotels as a Mirror of Economic Prosperity Hotels are more than temporary shelters—they are economic barometers, lifestyle enablers, and investment opportunities. When consumers begi

Introduction: Why Steel Shapes the Modern World Steel is the backbone of industrial civilization. From skyscrapers and bridges to automobiles, appliances, and defense equipment, steel permeates nea

Introduction: Why Banking Matters in India Banking is the backbone of every modern economy. In India, banks not only safeguard deposits but also fuel growth by lending to businesses, households, an