The Ultimate Guide to Sideways Trend Lines, Trading Psychology, and Winning Strategies

Introduction: Why Sideways Trends and Psychology Matter in Trading

Markets don’t always move up or down. Sometimes, they pause, consolidate, and move sideways. This phase—known as a sideways trend line—is critical for traders to understand. Combined with trading psychology and strategic execution, it forms the foundation of consistent success.

Part 1: Sideways Trend Lines – Consolidation and Range-Bound Markets

What is a Sideways Trend Line?

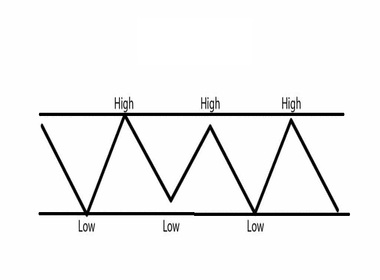

A sideways trend line indicates consolidation or range-bound markets. Prices move within a horizontal channel, neither making higher highs nor lower lows.

- Definition: A line drawn across equal highs or equal lows, showing balance between buyers and sellers.

- Purpose: Highlights indecision and consolidation phases.

- Signal: Breakouts from sideways ranges often lead to strong moves.

Characteristics of Sideways Trend Lines

- Flat slope: No upward or downward bias.

- Multiple touches: Price repeatedly tests support and resistance.

- Timeframe relevance: Common in short-term charts but can appear in weekly/monthly charts too.

How to Draw Sideways Trend Lines

- Identify horizontal highs and lows.

- Connect them to form a channel.

- Extend the lines forward to project consolidation zones.

Why Sideways Trends Are Crucial

- Reveal market indecision.

- Provide range-trading opportunities.

- Signal potential breakouts when price escapes the range.

Common Mistakes

- Misinterpreting sideways ranges as trends.

- Trading breakouts without confirmation.

- Ignoring volume analysis.

Part 2: Trading Psychology – The Mental Game of Markets

What is Trading Psychology?

Trading psychology refers to the mental and emotional state that influences trading decisions. It governs discipline, patience, confidence, and risk tolerance.

Key Psychological Biases

- Fear of loss: Closing trades too early.

- Greed: Over-leveraging or chasing profits.

- Overconfidence: Ignoring risk after wins.

- Impatience: Entering trades without setups.

Building a Strong Trading Mindset

- Discipline: Follow your plan.

- Patience: Wait for setups.

- Resilience: Accept losses.

- Adaptability: Adjust when markets change.

Techniques to Improve Psychology

- Journaling trades.

- Practicing mindfulness.

- Using smaller positions.

- Setting realistic goals.

Part 3: Trading Strategies for Sideways Markets

Range Trading Strategy

- Buy near support.

- Sell near resistance.

- Use stop-loss outside the range.

Breakout Strategy

- Wait for price to break above resistance or below support.

- Confirm with volume.

- Enter after retest for accuracy.

Swing Trading Strategy

- Trade medium-term moves within the range.

- Combine oscillators (RSI, Stochastic) with trend lines.

Scalping Strategy

- Trade small moves inside the range.

- Requires discipline and quick execution.

Matching Strategy with Psychology

- Patient traders → range trading.

- Aggressive traders → breakout trading.

- Fast-paced traders → scalping.

Part 4: Integrating Sideways Trend Lines, Psychology, and Strategy

The Three Pillars of Trading Success

- Sideways Trend Lines → Technical clarity.

- Psychology → Emotional stability.

- Strategy → Practical execution.

Example Workflow

- Identify sideways range.

- Confirm with indicators.

- Choose strategy (range or breakout).

- Apply psychological discipline.

- Execute with risk management.

Part 5: Advanced Insights for Professionals

Multi-Timeframe Analysis

- Use higher timeframe ranges for context.

- Trade lower timeframe for precision.

Risk Management

- Risk only 1–2% per trade.

- Use stop-loss and take-profit.

- Diversify assets.

Case Study: Sideways Trend Line + Psychology

A trader sees consolidation. Instead of forcing trades, they wait for breakout confirmation. Their patience avoids false signals.

Conclusion: The Path to Trading Mastery

Trading success is not about predicting perfectly—it’s about combining sideways trend line analysis, psychological discipline, and strategic execution. Master these three, and you’ll thrive in any market condition.