Broadening Wedge (Expanding Triangle) Chart Pattern: Psychology, Trading Strategies, and Risk Management

1. Introduction to the Broadening Wedge

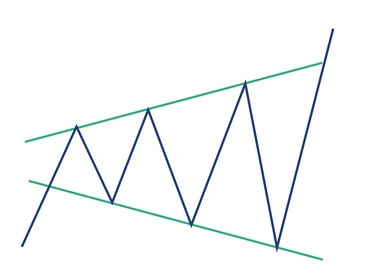

The Broadening Wedge, also known as the Expanding Triangle, is a chart pattern that reflects increasing volatility.

Unlike symmetrical triangles that narrow over time, the broadening wedge shows diverging trendlines, with progressively wider price swings.

Eventually, price breaks out of the wedge, often in the opposite direction of the last swing.

This breakout can signal either continuation or reversal, depending on the overall trend and volume behavior.

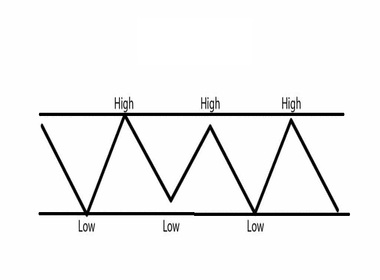

2. Anatomy of the Broadening Wedge

- Trendlines: Two diverging lines, one ascending and one descending.

- Price Swings: Each swing is wider than the previous one.

- Volume Behavior: Volume often increases with volatility, confirming the pattern.

- Breakout: Occurs when price escapes the wedge, typically opposite to the last swing.

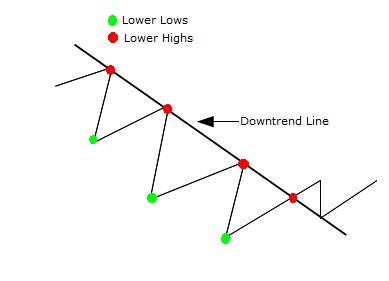

3. Market Psychology Behind Broadening Wedges

- Early Phase: Traders are indecisive, leading to volatile swings.

- Middle Phase: Confidence builds, but swings widen as buyers and sellers battle.

- Late Phase: Emotional extremes dominate, creating sharp moves.

- Breakout: One side finally overwhelms the other, leading to continuation or reversal.

This reflects investor psychology:

- Fear and greed amplify volatility.

- Institutions may distribute or accumulate during swings.

- Retail traders misinterpret swings as trend signals.

4. Types of Broadening Wedges

| Type | Direction | Typical Context | Psychology |

|---|---|---|---|

| Ascending Broadening Wedge | Upward divergence | Often bearish reversal | Buyers lose control |

| Descending Broadening Wedge | Downward divergence | Often bullish reversal | Sellers lose control |

| Symmetrical Broadening Wedge | Both lines diverge | Neutral, breakout either way | Indecision dominates |

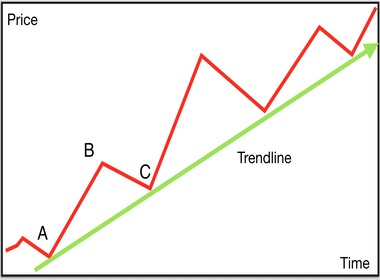

5. How to Trade the Broadening Wedge

Entry Strategies

- Breakout Entry: Trade in the direction of breakout after confirmation.

- Retest Entry: Wait for price to retest breakout level before entering.

- Aggressive Entry: Trade swings within the wedge with tight stops.

Stop-Loss Placement

- Below breakout level for bullish trades.

- Above breakout level for bearish trades.

Profit Targets

- Measure widest part of wedge.

- Project move equal to that distance after breakout.

6. Common Mistakes Traders Make

- Misidentifying symmetrical triangles as broadening wedges.

- Entering trades before breakout confirmation.

- Ignoring volume signals.

- Over-leveraging positions.

7. Advanced Trading Strategies

- Indicator Confirmation: Use RSI divergence, MACD crossovers, or moving averages.

- Multi-Timeframe Analysis: Confirm wedge on higher timeframes.

- Volume Profile Integration: Analyze volume distribution during swings.

- Swing Trading: Exploit volatility within wedge before breakout.

8. Broadening Wedge vs. Other Triangle Patterns

| Feature | Broadening Wedge | Symmetrical Triangle | Ascending Triangle |

|---|---|---|---|

| Shape | Diverging lines | Converging lines | Flat top, rising bottom |

| Psychology | Increasing volatility | Decreasing volatility | Bullish pressure |

| Breakout | Continuation or reversal | Continuation | Bullish |

9. Risk Management in Broadening Wedge Trading

- Always use stop-loss orders.

- Avoid trading without breakout confirmation.

- Manage position size carefully.

- Diversify trades to reduce exposure.

10. Case Studies: Broadening Wedges in Different Markets

- Stocks: Common during earnings-driven volatility.

- Forex: Appears in currency pairs during macroeconomic uncertainty.

- Crypto: Frequently seen during speculative rallies and corrections.

11. Conclusion

The Broadening Wedge (Expanding Triangle) chart pattern is a volatile formation that signals potential reversals or continuations. By understanding its psychology and applying disciplined trading strategies, traders can navigate volatility and capitalize on breakouts. Success requires patience, confirmation, and strict risk management.