The Complete Guide to Downtrend Lines, Trading Psychology, and Effective Strategies

Introduction: Why Downtrend Lines and Psychology Define Trading Success

Trading is not just about spotting opportunities—it’s about recognizing risks, managing emotions, and applying strategies with discipline. A downtrend line shows bearish momentum, psychology governs trader behavior, and strategy determines execution. Together, they form the backbone of consistent trading success.

Part 1: Understanding Downtrend Lines in Trading

What is a Downtrend Line?

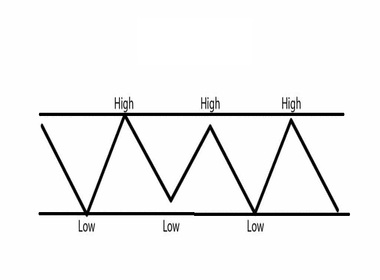

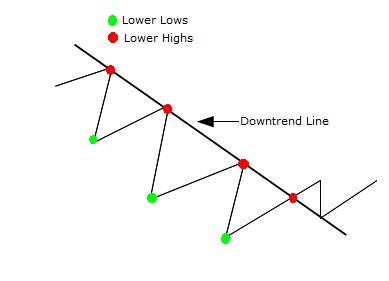

A downtrend line is a straight line drawn on a chart by connecting lower highs, showing that sellers dominate the market and push prices downward.

- Definition: A line sloping downward, connecting at least two significant highs.

- Purpose: Identifies resistance levels and confirms bearish sentiment.

- Signal: As long as price respects the line, the trend remains bearish.

Characteristics of a Downtrend Line

- Slope: Negative, indicating falling prices.

- Touches: At least two, ideally three, for confirmation.

- Timeframe relevance: Stronger on higher timeframes (daily, weekly).

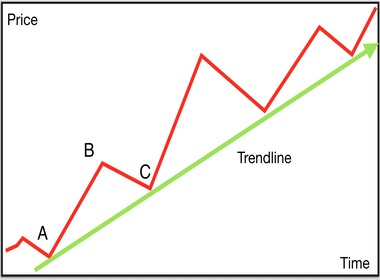

How to Draw an Accurate Downtrend Line

- Identify major swing highs.

- Connect them with a straight line.

- Extend the line forward to project future resistance.

- Adjust as new highs form.

Why Downtrend Lines Are Crucial

- Provide visual clarity in bearish markets.

- Help traders spot short-selling opportunities.

- Offer risk management by placing stop-loss above the line.

Common Mistakes

- Drawing lines on insignificant highs.

- Ignoring timeframe context.

- Over-relying on trend lines without confirmation.

Part 2: Trading Psychology – The Hidden Force Behind Success

What is Trading Psychology?

Trading psychology refers to the mental and emotional factors that influence trading decisions. It includes discipline, patience, confidence, and emotional control.

Key Psychological Challenges

- Fear: Closing trades too early or avoiding opportunities.

- Greed: Over-leveraging or chasing unrealistic profits.

- Overconfidence: Ignoring risk after a winning streak.

- Impatience: Entering trades without proper setup.

Building a Strong Trading Mindset

- Discipline: Stick to your plan.

- Patience: Wait for high-probability setups.

- Resilience: Accept losses as part of the process.

- Adaptability: Adjust strategies when markets change.

Techniques to Improve Psychology

- Journaling trades to track emotions.

- Practicing mindfulness or meditation.

- Using smaller position sizes to reduce stress.

- Setting realistic goals.

Part 3: Trading Strategies That Deliver Results

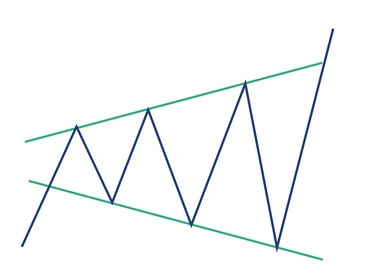

Trend-Following Strategy

- Identify the dominant trend using downtrend lines.

- Enter trades in the direction of the trend.

- Place stop-loss above the line.

Breakout Strategy

- Watch for price breaking below support.

- Confirm with volume.

- Enter after retest for higher accuracy.

Swing Trading Strategy

- Focus on medium-term moves.

- Combine trend lines with oscillators (RSI, Stochastic).

- Aim for favorable risk-reward ratios.

Scalping Strategy

- Trade small price movements on lower timeframes.

- Requires discipline and quick decision-making.

- Use tight stop-losses.

Matching Strategy with Psychology

- Patient traders → swing trading.

- Fast-paced traders → scalping.

- Long-term thinkers → trend-following.

Part 4: Integrating Downtrend Lines, Psychology, and Strategy

The Three Pillars of Trading Success

- Downtrend Lines → Technical clarity.

- Psychology → Emotional stability.

- Strategy → Practical execution.

Example Workflow

- Identify downtrend line.

- Confirm with indicators.

- Choose strategy (trend-following, breakout).

- Apply psychological discipline.

- Execute with risk management.

Part 5: Advanced Insights for Professionals

Multi-Timeframe Analysis

- Use higher timeframe trend lines for context.

- Trade on lower timeframe for precision.

Risk Management

- Never risk more than 1–2% per trade.

- Use stop-loss and take-profit levels.

- Diversify across assets.

Case Study: Downtrend Line + Psychology in Action

A trader spots a downtrend line forming. Instead of rushing in, they wait for confirmation. Their patience prevents a false breakout loss. This is where psychology saves capital.

Conclusion: The Path to Trading Mastery

Trading success is not about predicting the market perfectly—it’s about combining downtrend line analysis, psychological discipline, and strategic execution. Master these three, and you’ll transform chaos into clarity.