Triple Bottom Chart Pattern: Psychology, Trading Strategies, and Risk Management

1. Introduction to the Triple Bottom Pattern

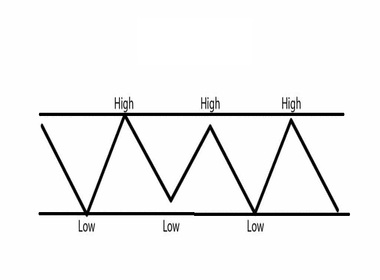

The Triple Bottom chart pattern is a bullish reversal formation.

It occurs when price tests a support level three times without breaking below, signaling weakening bearish momentum.

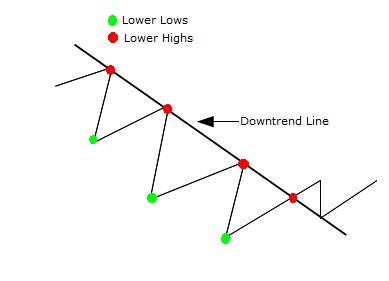

Traders use the triple bottom to anticipate trend reversals, especially after prolonged downtrends.

2. Anatomy of the Triple Bottom

- Support Line: Price bottoms three times at the same level.

- Resistance Line: A horizontal neckline forms above the bottoms.

- Breakout: Confirmation occurs when price breaks above resistance.

- Volume Behavior: Volume often decreases during bottoms and rises during breakout.

3. Market Psychology Behind Triple Bottoms

- First Bottom: Fear dominates, sellers push price lower, but support holds.

- Second Bottom: Bears attempt again, but buyers defend support.

- Third Bottom: Sellers fail once more, signaling exhaustion.

- Breakout: Buyers dominate, triggering reversal.

This reflects investor psychology:

- Repeated defense of support builds confidence.

- Smart money accumulates positions.

- Retail traders join after breakout confirmation.

4. How to Trade the Triple Bottom Pattern

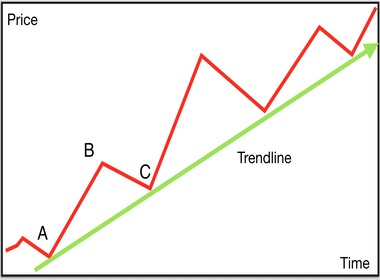

Entry Strategies

- Breakout Entry: Buy when price closes above resistance.

- Retest Entry: Enter after price retests resistance as new support.

- Aggressive Entry: Buy near support during third bottom with tight stop-loss.

Stop-Loss Placement

Below the support line.

Profit Targets

- Measure height of pattern (support to resistance).

- Project upward move equal to that height after breakout.

5. Common Mistakes Traders Make

- Entering before breakout confirmation.

- Misidentifying double bottoms or ranges as triple bottoms.

- Ignoring volume signals.

- Over-leveraging positions.

6. Advanced Trading Strategies

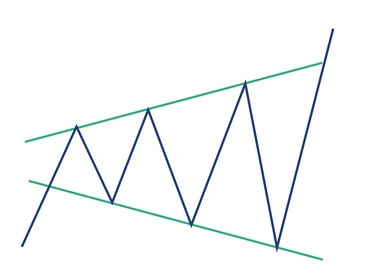

- Indicator Confirmation: Use RSI divergence, MACD crossovers, or moving averages.

- Multi-Timeframe Analysis: Confirm triple bottom on higher timeframes.

- Volume Analysis: Rising volume during breakout validates reversal.

7. Triple Bottom vs. Other Reversal Patterns

| Feature | Triple Bottom | Double Bottom | Inverse Head & Shoulders |

|---|---|---|---|

| Bottoms | Three | Two | Three (middle bottom deeper) |

| Psychology | Repeated defense of support | Two failed attempts | Accumulation phase |

| Reliability | High | Moderate | High |

8. Risk Management in Triple Bottom Trading

- Always use stop-loss orders.

- Avoid trading without volume confirmation.

- Manage position size carefully.

- Diversify trades to reduce exposure.

9. Case Studies: Triple Bottom in Different Markets

- Stocks: Common after prolonged declines in undervalued equities.

- Forex: Appears in currency pairs during support tests.

- Crypto: Frequently seen during speculative sell-offs before sharp rallies.

10. Conclusion

The Triple Bottom chart pattern is a reliable bullish reversal signal. By understanding its psychology and applying disciplined trading strategies, traders can anticipate market turning points. Success requires patience, confirmation, and strict risk management.