What are the types of analysis?

Investors and traders use different kinds of research to help them make smart choices on the stock market. In general, these can be broken down into three main groups:

Fundamental Analysis:

In this type of analysis, the financial health of a company is looked at, including its earnings, assets, debts, and growth possibilities. To find out how much a stock is really worth, fundamental analysts look at things like how the company is run, business trends, competitive advantages, and the state of the economy. A lot of the time, they use financial measures like price-to-earnings (P/E), earnings per share (EPS), and price-to-book (P/B) to figure out how appealing a stock is.Technical Analysis:

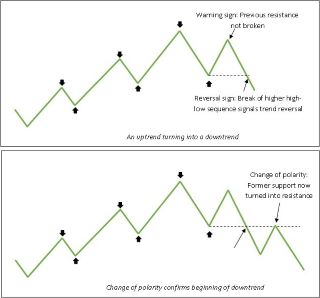

Technical analysis looks at past market data, mostly price and volume, to guess how prices will move in the future. Technical experts look at charts and different technical indicators, like Fibonacci retracements, moving averages, MACD (Moving Average Convergence Divergence), and more, to find patterns and trends in stock prices. They use past price trends to help them decide what to trade because they think those patterns will happen again.Sentiment Analysis:

To figure out how the market is feeling as a whole, sentiment analysis looks at market emotion or investor psychology. Some examples of this are looking at news headlines, conversations on social media, investor polls, and mood indicators. Contrarian investors often use sentiment analysis to find buying or selling chances when the market mood changes from too positive or negative, which could cause the market to reverse.

Post Comment